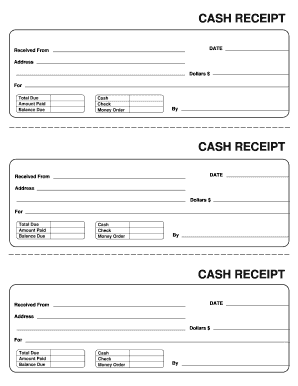

India Receipt of House Rent 2020-2026 free printable template

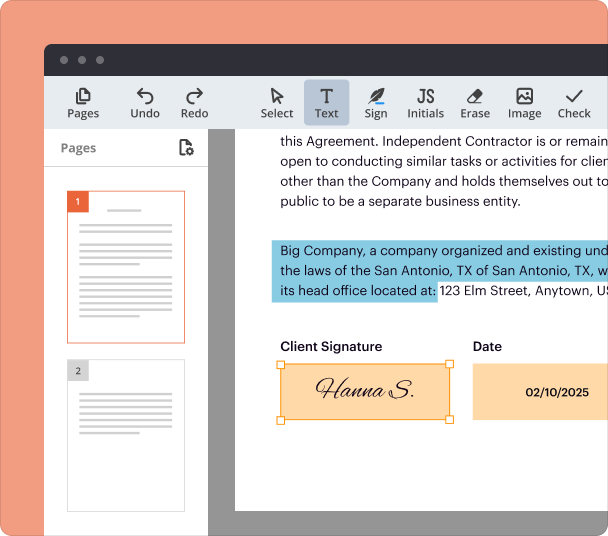

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

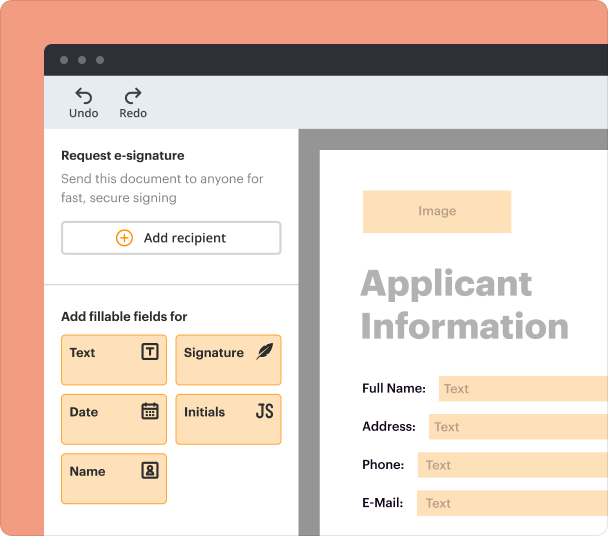

Create professional forms

Simplify data collection

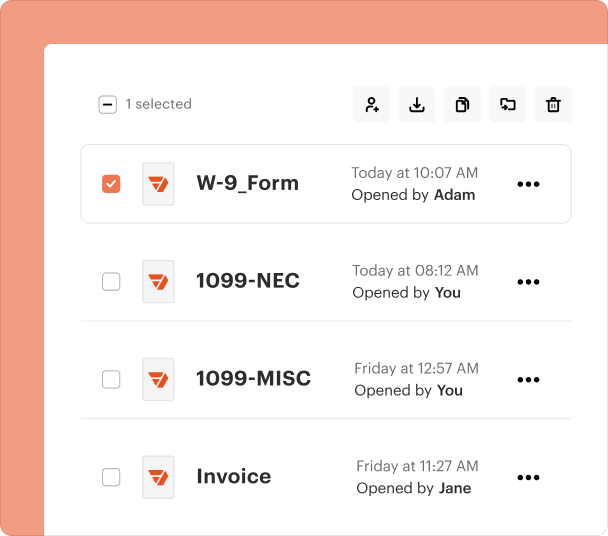

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

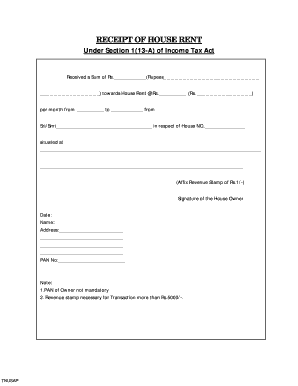

Understanding the India Receipt of House Form

What is the India Receipt of House Form?

The India Receipt of House Form is a crucial document for landlords and tenants, serving as proof of rent payments made for residential properties. This form outlines the key details of the rental agreement and is typically used for tax purposes under Income Tax regulations.

Key Features of the India Receipt of House Form

This form includes important elements such as the names and addresses of both the landlord and tenant, rent amount, payment frequency, and property details. Additionally, it must be signed by the landlord, providing legal acknowledgment of the rent received.

When to Use the India Receipt of House Form

Landlords should use this form each time they receive rent payments from tenants. It serves as a formal receipt and can be essential for both parties during tax season or in case of any disputes regarding rental agreements.

Required Documents and Information

To complete the India Receipt of House Form, information such as the landlord's name and address, tenant's name, rental amount, payment date, and property details must be provided. Ensuring that all information is accurate helps avoid future discrepancies.

How to Fill the India Receipt of House Form

Filling out the form involves entering information in designated fields clearly. Start with the landlord's details, followed by tenant information, the rent amount, and the property address. Ensure to sign and date the document to validate the receipt.

Best Practices for Accurate Completion

To ensure the form is properly filled, double-check all entries for accuracy and clarity. Using digital platforms like pdfFiller can streamline this process, enhancing ease of use and providing a record of completion for future reference.

Common Errors and Troubleshooting

Common mistakes when filling out the India Receipt of House Form can include incorrect amounts, missing signatures, or incomplete address details. Reviewing the form after completion helps identify errors that could cause issues later.

Frequently Asked Questions about in receipt house rent form

Is the India Receipt of House Form necessary for tax purposes?

Yes, it is important for documenting rental income and may be required during tax filing.

Can tenants request a copy of the receipt?

Yes, tenants have the right to request a copy of the receipt for their records.

pdfFiller scores top ratings on review platforms